Investments are the financial cushions made to benefit from in the future. It has myriad facets like some people consider investing in health, personal grooming, skills, and education as an investment too. In common context, investment is plowing money into:

– Financial product

– Property

– Commercial venture

– Shares

This financing is done with the intention to make/ gain profits (more than the invested money) in the times ahead.

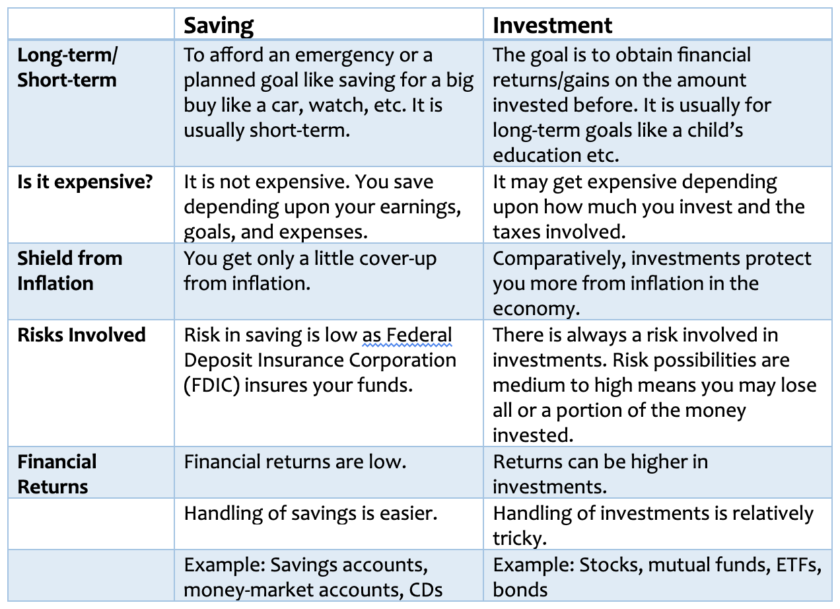

Saving vs. Investment

Both are made by people with the futuristic approach and to save money. Though, key differences include:

When to Start Investing?

Whatever your age is, it’s high time to think about investing. The earlier the better because even if you lose – you gain knowledge of the highs and lows of investments. This gen would aid you to make better decisions and better profits later.

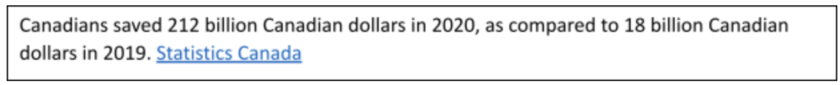

Also, you would learn to better cope up with uncertain times like recently the world faced in the pandemic. People who had savings and investments were better able to survive Covid lockdowns.

Investments are trickier to handle as compared to savings, some signals that you can manage them wisely are:

1. Financial Goals

If your head is clear on why you want to invest and what you will be doing with the money, you would certainly have a direction and motivation to invest and manage investments routinely to achieve long-term goals like saving for retirement.

2. Emergency Fund

If you have some money saved in this fund (experts advise to save up to three months of expenses at least), you can handle investment better in a way that if a crisis occurs, you would cover it up with this emergency fund without disturbing investments made for future goals.

3. Monthly Savings

You clear debt interests and bills timely. Plus you have a good amount of emergency funds. Still, have some extra money (it does not have to be very big btw)? It is good to invest in – starting small, researching, and growing over time.

Benefits of Investing at a Young Age

Canadians can buy stocks and own a credit card with a minimum age of 18 (before that you may do so on behalf of your parents).

If students begin to cope up with financial products like stocks and bonds, own and manage the best student debit cards, and best student credit cards in Canada – they are bestowing themselves a wholesome experience which they can utilize to get big gains in the future.

Whether you are a student or not, savings and financial management at a young age are always a good idea.

Money, Investments, and Coronavirus

Financial markets have their ebbs and flows. Investors rely on research, experience, and financial advisers to guide them through the journey.

March 2020 onwards pandemic led to significant shocks in the stock market – and people responded differently to such a situation.

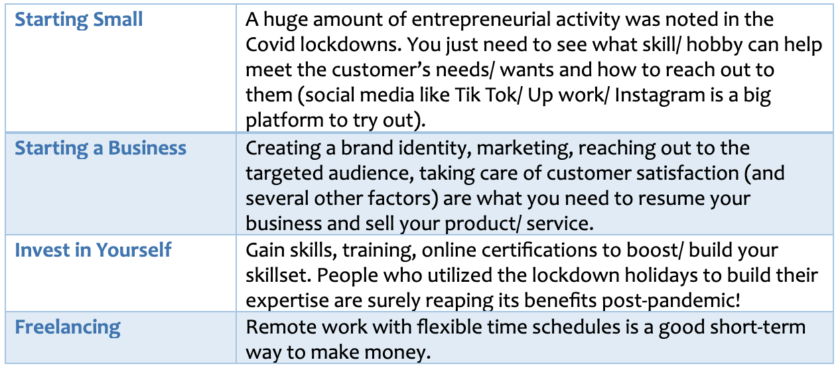

Money Ideas to Jump Covid-19 Employment Roadblocks

Some money ideas to jump Covid-19 employment roadblocks before discussing profitable investments are as under:

Pandemic-focused Investment Guide

While choosing/ researching an investment option, take care of a few things like (pandemic friendly advice):

1. Emerging Markets

Emerging markets mean developing country markets. Sometimes such markets outperform the markets of developed countries (careful and in-depth research is required to make a sound decision).

This case is not always applicable, and at times emerging markets suffer:

– Inflation

– Job losses

– Unmaintainable debts

– Affected health systems

These are some of the factors which disturb investment activities in developing countries.

2. Liquid Assets/ Liquid Money

Keeping some money in liquid (including assets and investments which can be converted to cash real quick without any penalty) can aid you in affording emergencies (like hospital trips/ vehicle accidents) worry-free. It also saves you from utilizing unsecured and secured credit cards (wherever possible).

One pitfall however is the tax obligations if you keep too much cash on hand.

3. Tech Stocks

Nearly everything went online in and post-coronavirus. Technology industry stocks surged and provided a good opportunity for the public to invest and gain financial returns.

4. Digital Assets

In today’s era, the significance of crypto/ digital assets cannot be denied.

Some of them performed quite well than traditional assets in lockdown.

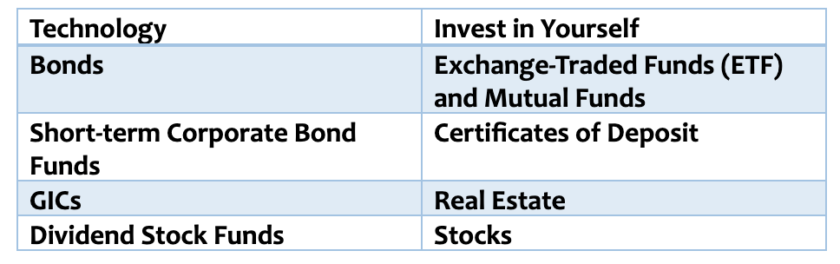

Profitable Investments that can help you survive Covid-19 better

We have seen the economic ups and downs since last year due to the Covid-19. Let us look into some profitable investments that you may consider making in 2021:

1. Technology

The pandemic lockdown and touch-avoidance protocols boomed the technology industry all over the world. From buying groceries and food online to working from home to paying bills on the web, to shopping, and buying medicines – we saw numerous startups mushroom in the pandemic times.

Customer’s awareness of tech’s significance has blessed tech stock and now more and more companies are experimenting with:

– Cyber security

– Data analytics

– Customer service

– Cloud computing

2. Bonds

Governments/ businesses take a loan from individuals and individuals receive interest in return. The loan amount is also returned on the maturity date (which is why this investment is considered low-risk).

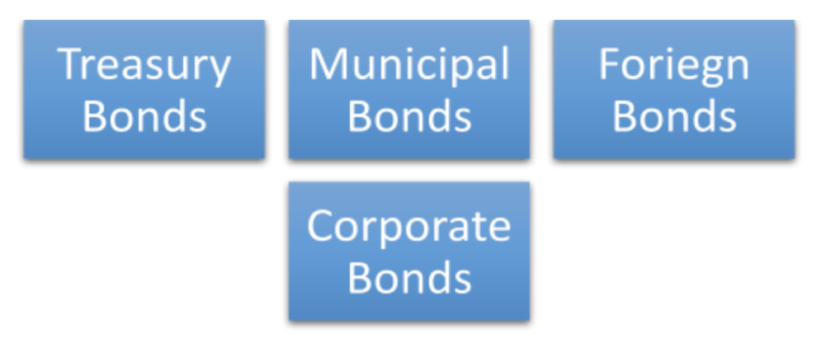

Four main types of bonds for investors are:

These are considered fixed-income payments. You can also resell your bonds at a higher price. However, bonds give lesser returns than stocks and returns may decrease/ fall over time.

3. Short-term Corporate Bond Funds

The objective of these bonds is to cater to the people who want to bear less risk of losing (due to interest fluctuations as happens in long-term bonds). One to five years is the average maturation age of these bonds.

Corporate bond funds are issued by many corporations together and investors can utilize these to build their cash flows.

4. GICs (Guaranteed Investment Certificate)

Both risks and returns are lower in this type of investment. You are paid a fixed amount of interest annually for a fixed period of time (usually one to five years).

The returns are low but investors can earn returns over their principal investments. Savings account are quite similar to guaranteed investment certificates.

5. Real Estate

Real estate investments are a good investment alternative for people who can bear the high risk and want high returns (profits are not always the case). You purchase a property, commit your time, and sell at the right time to gain profits.

On the other hand, real estate is

An expensive investment

– Its liquidity is low

– High maintenance expenses

– High carrying costs: taxes, insurance

6. Dividend Stock Funds

These stock investments pay dividends (usually on a quarterly basis). The organization’s board of directors pays a portion of their earnings as dividends to the shareholders. Due to the dividend payments, these stocks become less risky.

It’s suitable for investors who want an income (as dividends) while investing an amount for a longer period. Some industries give high dividends than others.

So, it’s always a good idea to research well and choose a high-performing industry to invest in!

7. Stocks

Companies list their shares (as stocks) on the stock market and people purchase them. If you are a shareholder of a company, you have some rights: you can select the company’s board members, and you are given some portion of the company’s earnings.

Stocks can be risky but with good research and having a portfolio of different stocks, it’s a good investment option.

8. Life and health insurance stocks:

Post pandemic this industry is just booming since more and more people are investing in health insurance. Some fine life and health insurance company stock options for investment are:

Idexx Laboratories: (IDXX)

Intuitive Surgical: (ISRG)

Johnson & Johnson: (JNJ)

Danaher: (DHR)

9. Certificates of Deposit CDs

Certificates of deposit have various kinds and have high time commitment. This means that once you have invested in CD, you would be getting your principal investment after a fixed maturity period (which can be from weeks to months).

The interest is paid at regular intervals, it’s best for investors who have no problem with locking their investments for a longer time and accept interests meanwhile.

10. Exchange-Traded Funds (ETF) and Mutual Funds

Like a stock, exchange-traded funds are traded on an exchange. They have low to medium risks and have low fees. They track underlying indexes. Investors can purchase funds from different markets and different industries.

Securities are bought from the money collected from various investors in mutual funds. Portfolio managers are hired to beat the benchmark index. These funds have high fees and may also have commissions.

FAQs

Can credit cards be used to purchase stocks?

You can utilize your credit card to buy stocks. However, it is not considered a wise activity because stock investment has the risk of loss.

You will engage yourself in both the investment money loss and high-interest credit card balance, in case of purchasing stock with your credit card.

Which is the best Canadian bank stock to buy?

– Canadian Imperial Bank of Commerce (TSX:CM)

– The Royal Bank of Canada (TSX:RY)

– Toronto Dominion Bank (TSX:TD)

What is passive investing?

Unlike active investors, passive investors do not react to market fluctuations. They invest in the long term. This style of investment is more transparent and requires lesser expenses (expenses to monitor index securities).

What is active investing?

In active investment, a portfolio manager makes effort to beat the average returns of the stock market. He/ she takes benefit of the fluctuations in price and knows the best times to sell or buy the stocks/ bonds.

How can I grow my money fast?

– Invest

– Start a part-time job

– Manage and track your income, saving, spending, and investment

Can Investing be Disadvantageous?

Some drawbacks of investment could be:

– There is no promised rate of profit/ return. If there is a market fluctuation, the investments may perform badly.

– If you are an investor and don’t keep a track of your buying and selling of stocks (you may hire a financier for this job), you would end up paying more taxes.